Over the next five years, home prices are expected to appreciate 3.24% per year on average and to grow by 21.4% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.

So, what does this mean for homeowners and their equity position?

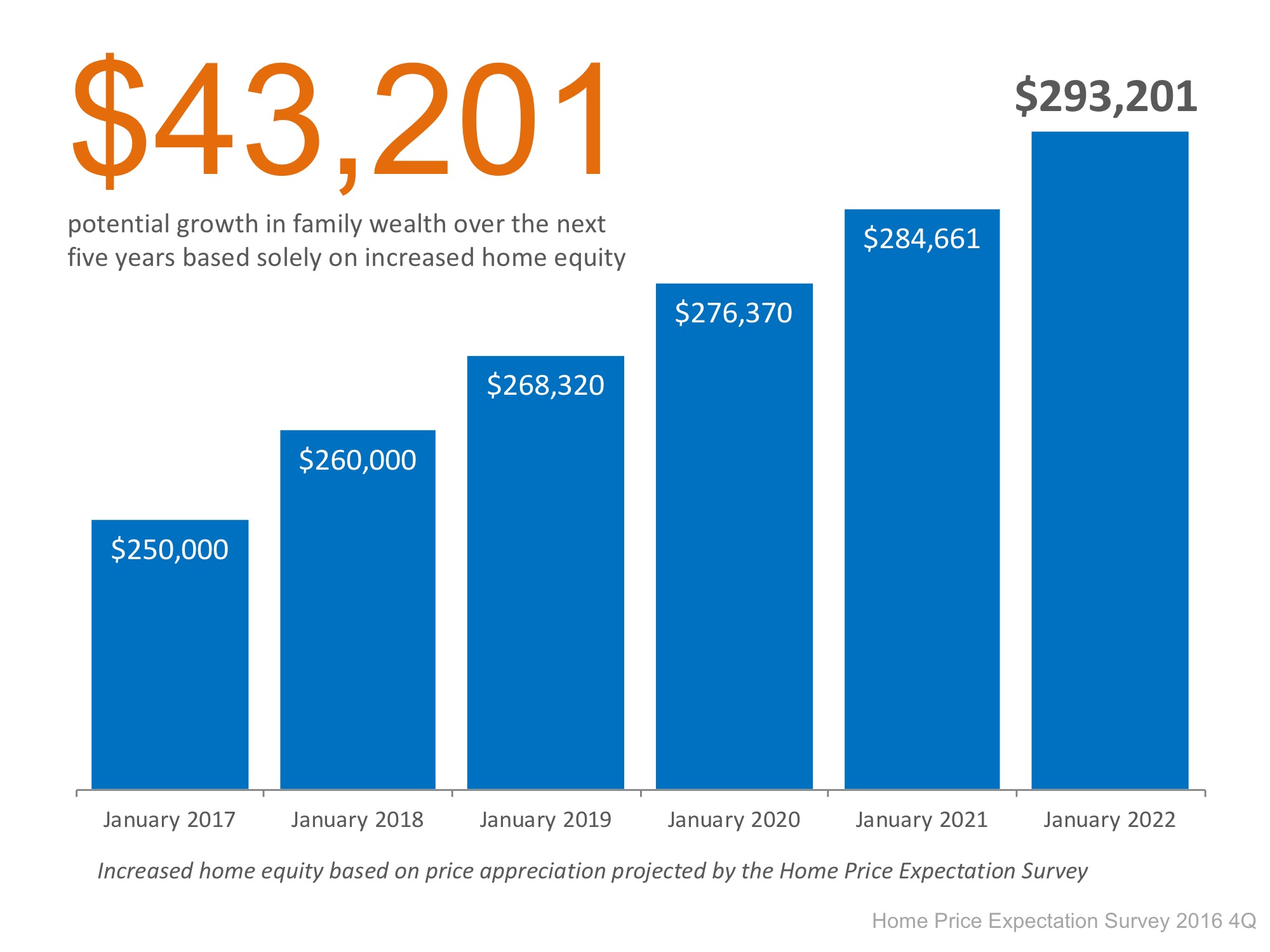

As an example, let’s assume a young couple purchases and closes on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?

Since the experts predict that home prices will increase by 4.0% this year alone, the young homeowners will have gained over $10,000 in equity in just one year.

Over a five-year period, their equity will increase by over $43,000! This figure does not even take into account their monthly principal mortgage payments. In many cases, home equity is one of the largest portions of a family’s overall net worth.

Bottom Line

Not only is homeownership something to be proud of, but it also offers you and your family the ability to build equity you can borrow against in the future. If you are ready and willing to buy, let’s get together to find out if you are able to, today!

DEC

2016

About the Author:

With over ten years of office management experience Tara is very eager and equipped to take on any challenge presented to her. She is detail oriented and uses her passion for customer service to ensure every client feels welcomed and taken care of. She utilizes her outstanding interpersonal and analytical skills to communicate with the Altitude Team to more effectively and efficiently maximize your buying or selling experience.