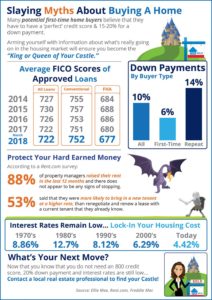

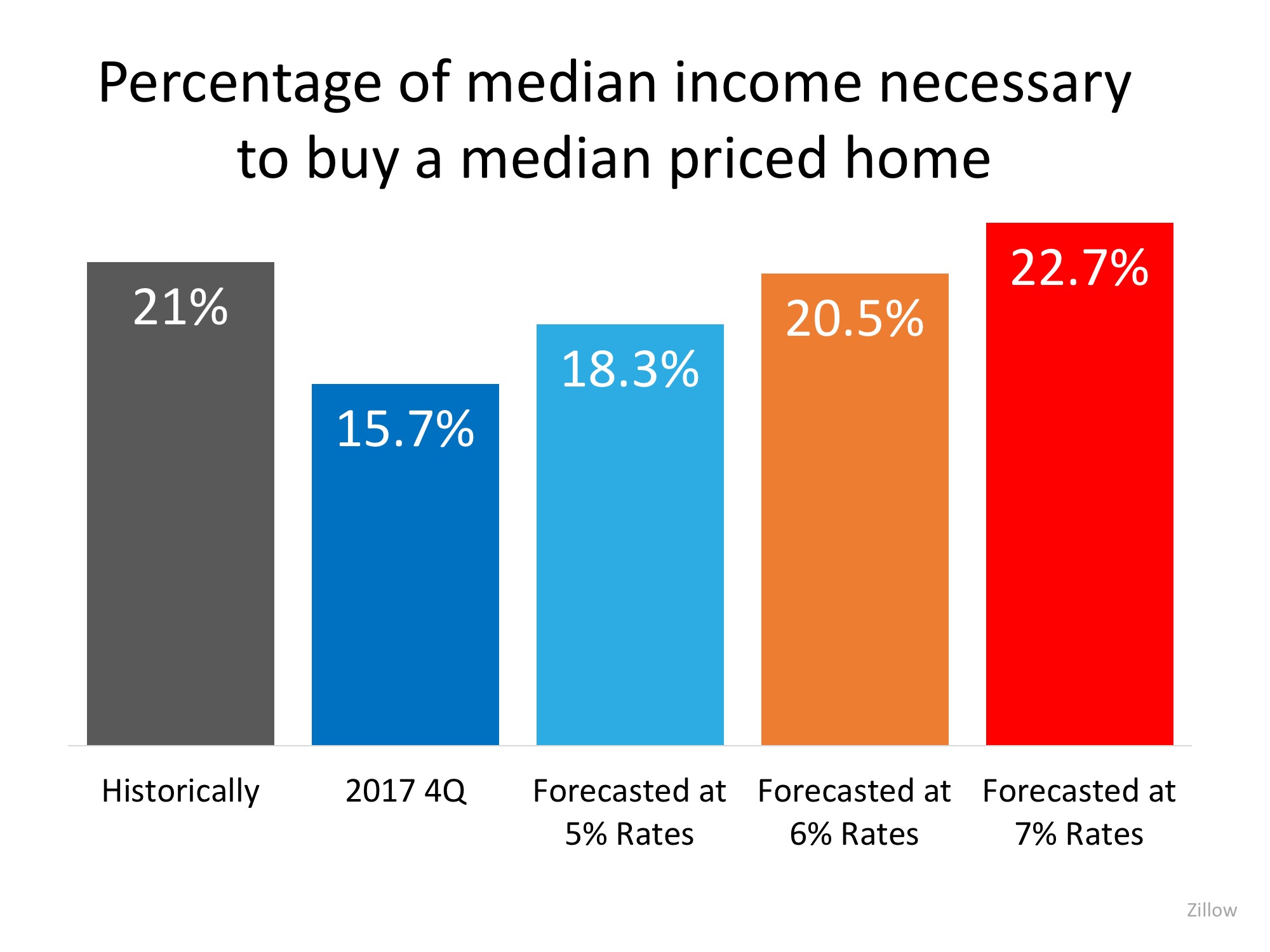

As home prices and interest rates climb across the country, you may be wondering if homeownership is all it is cracked up to be. After all, as the value of the homebuying dollar decreases and the amount of home that dollar can buy decreases, it might seem more-appealing to rent rather than put all your eggs in one basket.

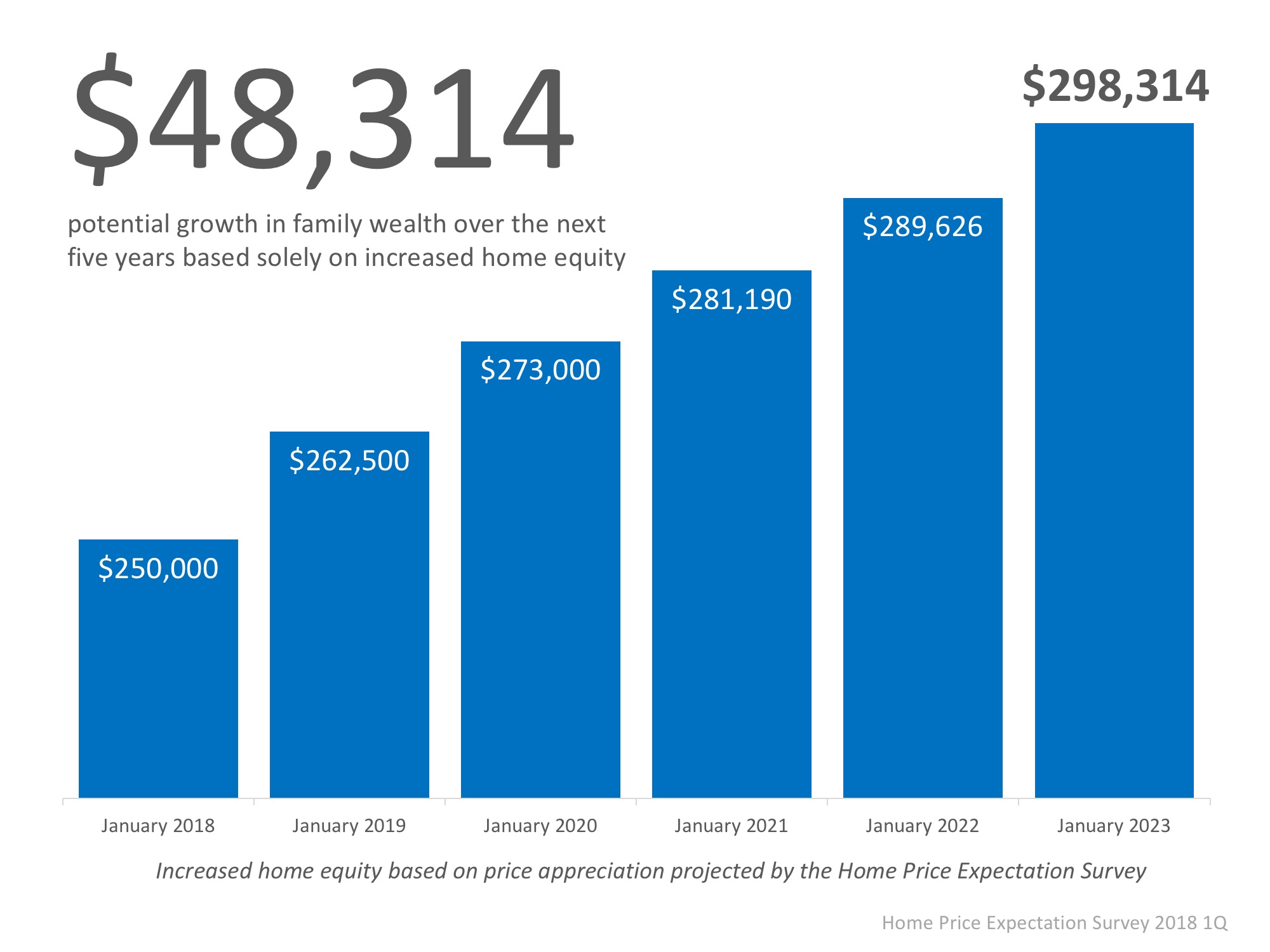

However, the appeal of not owning soon fades when you do the math. The Federal Reserve conducts their Survey of Consumer Finances across the country every three years and released their latest findings in October 2017. It determined that the median net worth for a family who owned a home was $231,400 in 2016 as opposed to $5,200 for a renter. How is this possible? Annual rent increases and appreciation on homes are big drivers of this disparity. Here is how it works:

Say someone is trying to choose between renting and owning a home. The type of rental property that suits their needs is $1,000 a month. But remember, that just represents today’s rent – not tomorrow’s. In this case, let’s assume a 5% rental increase per year:

|

Monthly Rent |

Annual Rent Paid |

Equity Gained |

| Year 1 |

$1,000 |

$12,000 |

$0 |

| Year 2 |

$1,050 |

$12,600 |

$0 |

| Year 3 |

$1,103 |

$13,236 |

$0 |

| Year 4 |

$1,158 |

$13,896 |

$0 |

| Year 5 |

$1,216 |

$14,592 |

$0 |

In the above example, this renter has paid $66,324 over five years and had zero gain in equity which would grow their net worth. In fact, this renter has helped their landlord increase his or her net worth and all the while, rental rates are rising. Now let’s look at an example of what it might look like to own a comparable home with a market value of $200,000 upon purchase with 10% down:

| End Of |

Property Value* |

Monthly Payment** |

Mortgage Balance |

Equity*** |

| Year 1 |

$210,000 |

$912.03 |

$177,096 |

$32,904 |

| Year 2 |

$220,500 |

$912.03 |

$174,059 |

$46,441 |

| Year 3 |

$231,525 |

$912.03 |

$170,882 |

$60,643 |

| Year 4 |

$243,101 |

$912.03 |

$167,560 |

$75,541 |

| Year 5 |

$255,256 |

$912.03 |

$164,084 |

$91,172 |

*Assumes 5% annual appreciation

**Monthly payment includes principal and interest on a $200,000 property with 10% down ($20,000) at 4.5%, 30 year fixed rate. Does not include PMI, property taxes, or homeowner’s insurance.

***Difference between what you owe and the possible market value for your home.

This smart buyer has taken advantage of today’s low cost of borrowing to leverage their $20,000 down payment into a $91,172 equity position in just five short years. That is a great way to grow one’s net worth! And because they took out a 30-year fixed rate mortgage, those principal and interest payments don’t increase for the life of the loan. Twenty-five years in the future when our example renter is paying $3,225 for their monthly rent, our homeowner will still be paying a cool $912.03.

Do you have additional questions about how this works? Call, text, or email and I will be happy to provide you with additional information: 253-222-2626 or john@altitude-re.com.