What You Need to Know About Buying and Selling Real Estate in 2017

What You Need to Know About Buying and Selling Real Estate in 2017

2016 was a whirlwind year for real estate. Many areas continued to see market price growth – some areas and price points gained more modestly than others. While there are still many unknowns as to what impact a new administration will have on the real estate market as the policies that affect our economies are still being formed, here is a broad overview of what you can expect if you are buying or selling a home in the year ahead:

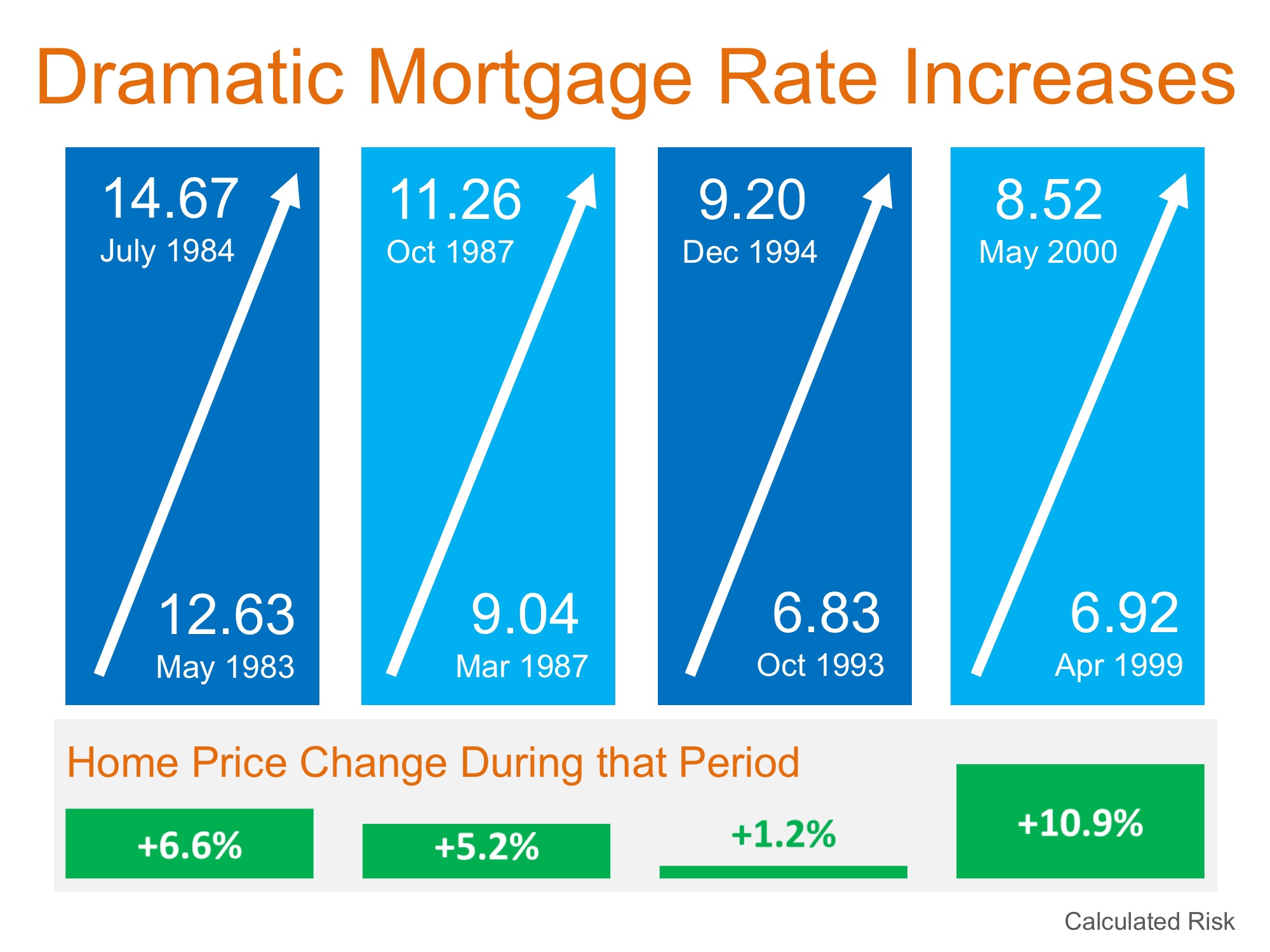

Interest rates will be on the rise – There has been a rise in interest rates over the last few weeks and the Federal Reserve just raised the short term interest rate at their December meeting which should impact mortgage rates. They also indicated that there would be additional raises in 2017. It would not be surprising to see interest rates closing in on 4.75% by the end of 2017. Interest rates will affect buyer buying power and this coupled with the rise in home prices in the last few years may cause some buyers to not buy. If these are sellers who decide to stay put, this may cause added pressure on inventory, although fewer buyers may reduce the pressure on inventory. A change in interest rates will certainly shake things up.

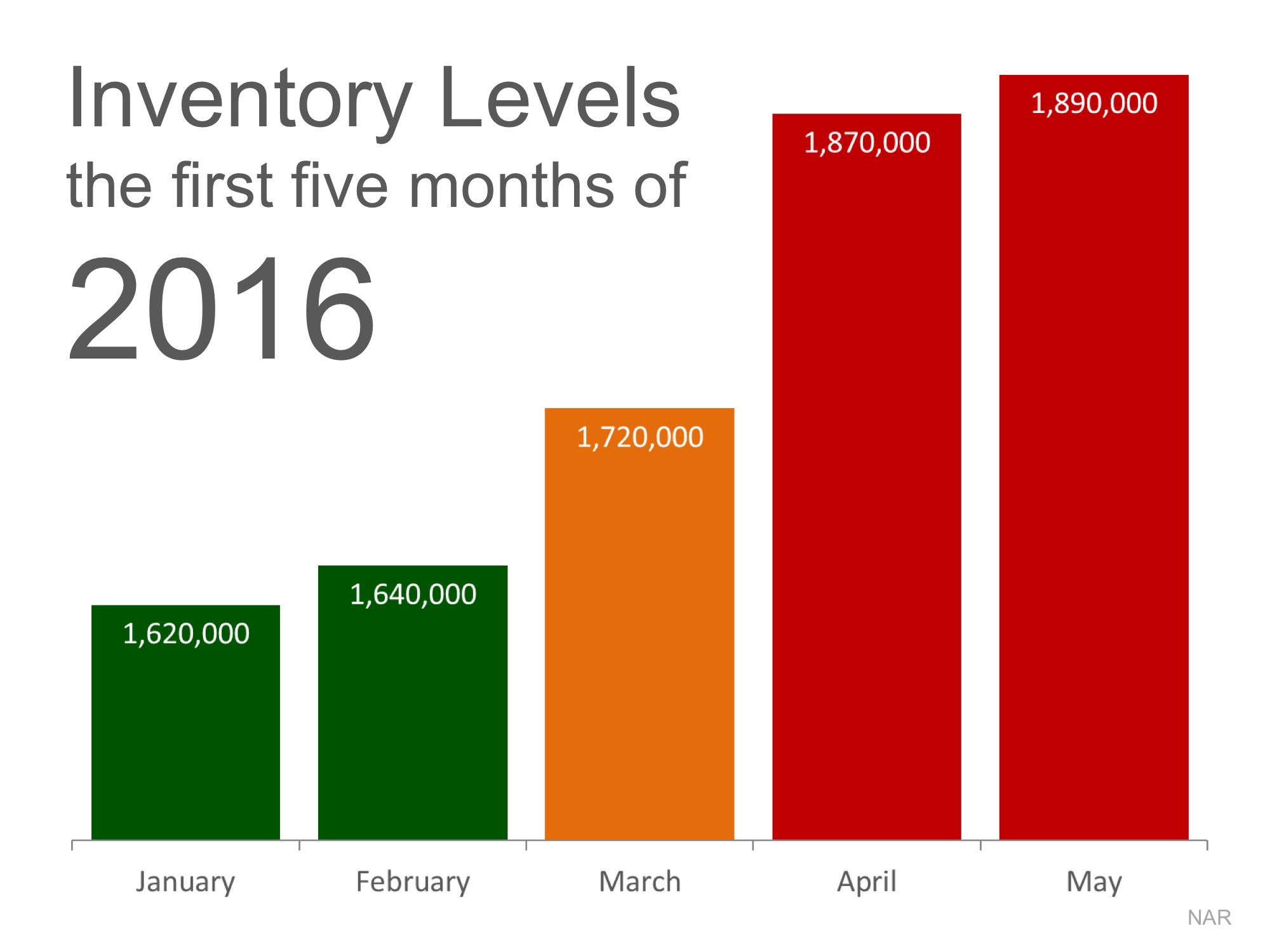

The inventory challenges of years past will not disappear in 2017 – There is a five million unit deficit in new housing units which is not expected to lighten up until at least mid-2018. This coupled with high demand from population increases due to booming job markets and more demand from Millennial buyers has make our housing inventory very tight. Inventory will still be a challenge in 2017 which is great for sellers who are buying in a lower-demand price point, buying a housing product that is in lower-demand, or buying in an area with lower-demand.

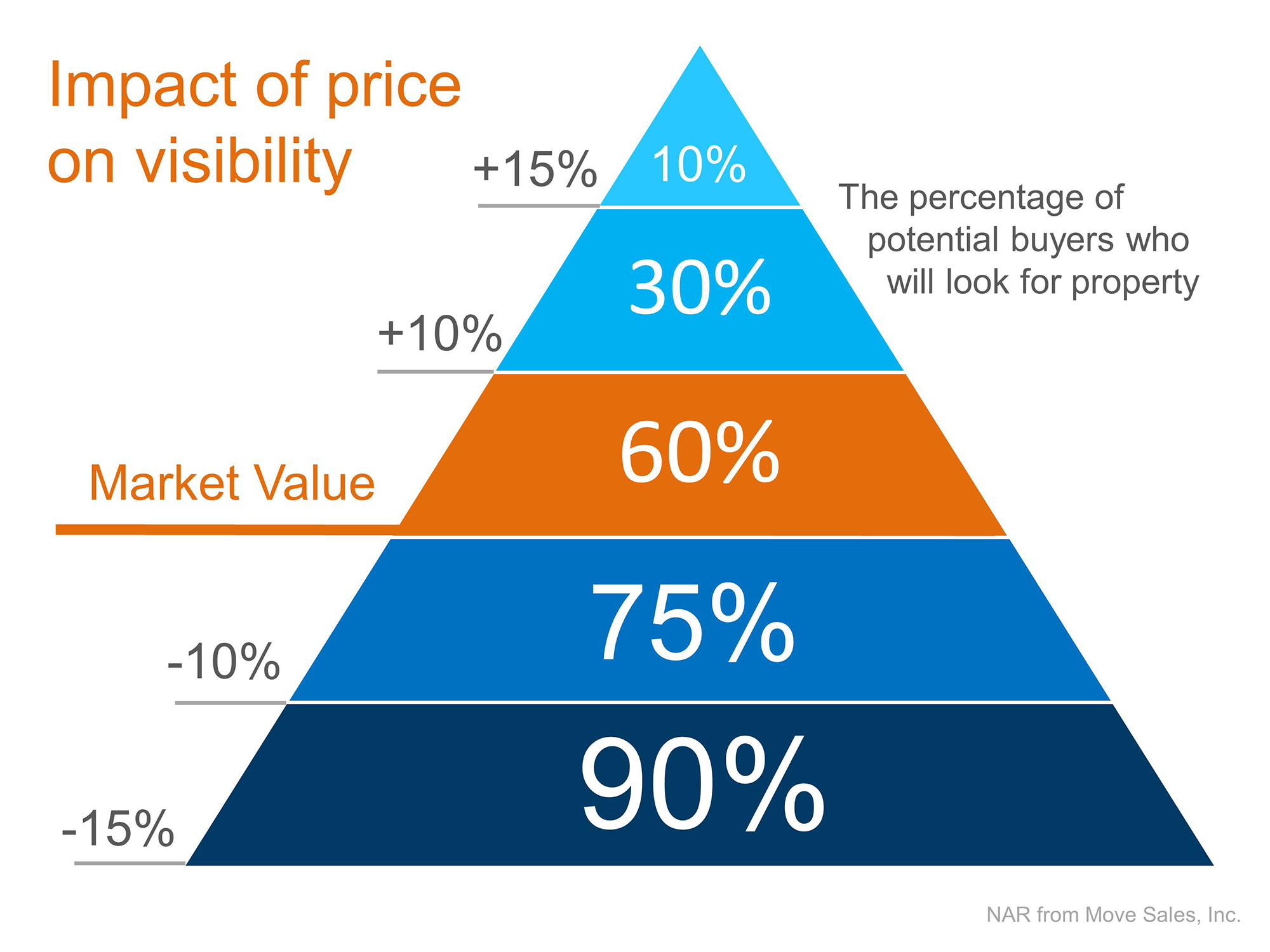

No amount of technology can replace the expertise of a full-service real estate agent – Although there will continue to be new real estate innovations released and improved on in 2017, there is no substitute for personal expertise. Whether buying or selling you need the experience of an agent in the field every day looking out for your needs. A computer can’t value the feeling you get when standing on a deck watching the sunset or the wow factor that just the right granite countertop can have on a potential buyer. Don’t trust your biggest asset to anything but the best in personal care.

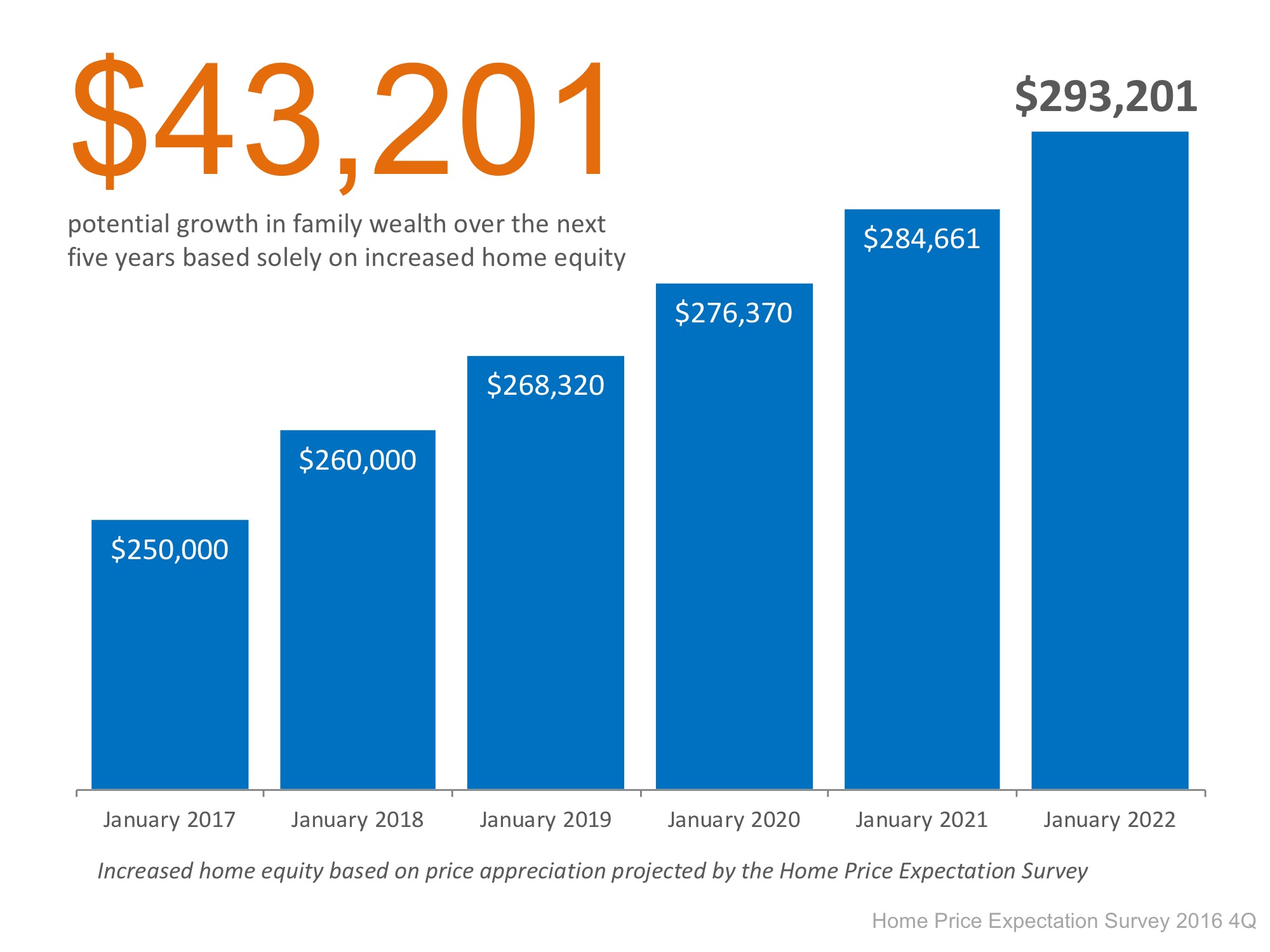

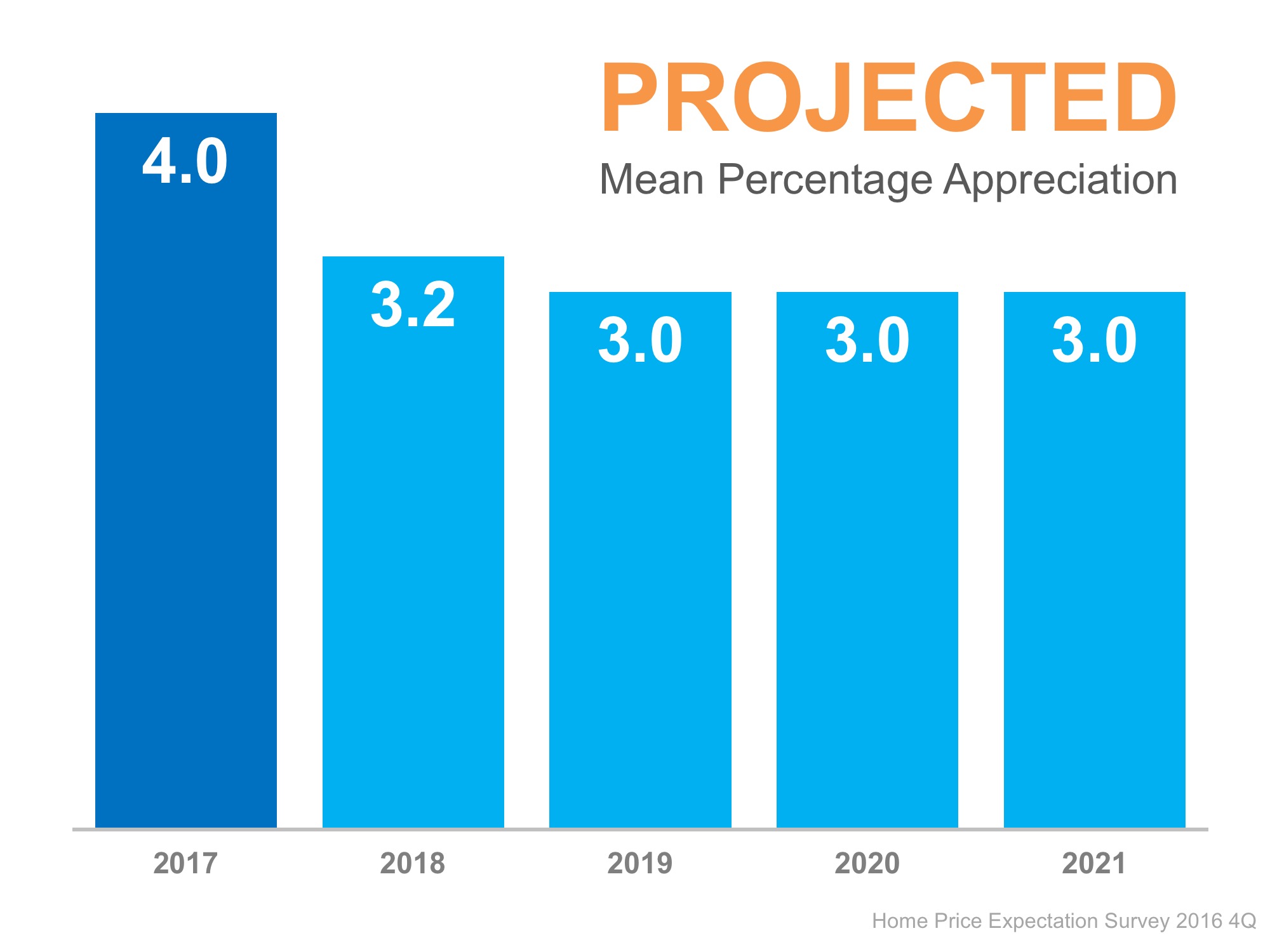

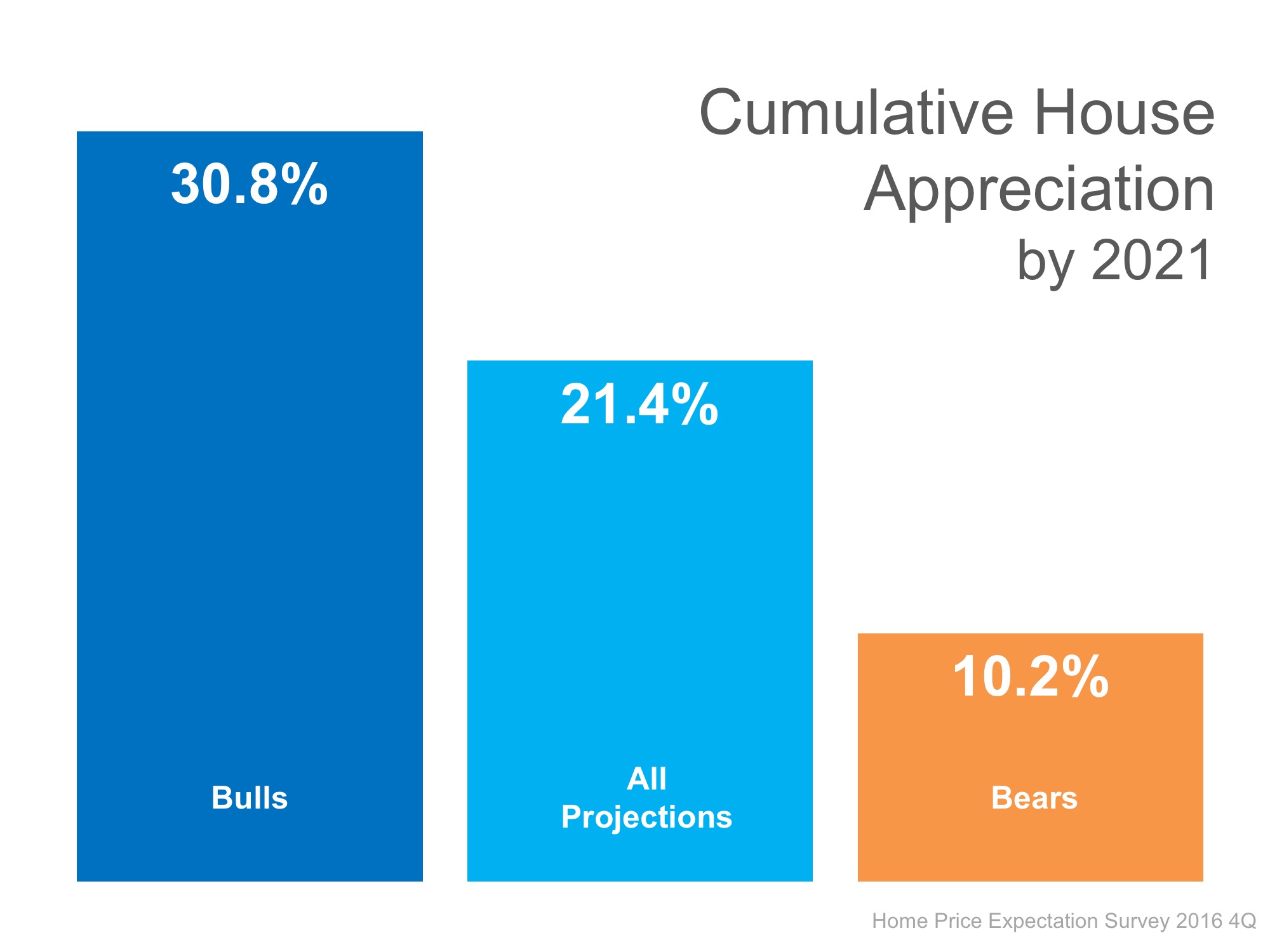

The best time to invest is still right now – With the lack of inventory and prices and interest rates on the rise, your real estate investment dollar will likely buy you more today than it will tomorrow. There is no time like the present. I look forward to discussing your particular plan developing your custom strategy to reach your goals.

I am excited for the opportunities that lie ahead in 2017 and welcome the opportunity to discuss the state of your current real estate investment so you can plan better and determine your updated net worth! Call or text me: (253) 222-2626 or send an email to: john@altitude-re.com.

![Americans Are on The Move [INFOGRAPHIC]](https://altitude-re.com/wp-content/uploads/2016/12/MovingAcrossAmerica2016-STM-1046x1354.jpg)