Buying a home can be intimidating if you are not familiar with the terms used during the process. To start you on your path with confidence, we have compiled a list of some of the most common terms used when buying a home.

Freddie Mac has compiled a more exhaustive glossary of terms in their “My Home” section of their website.

Annual Percentage Rate (APR) – This is a broader measure of your cost for borrowing money. The APR includes the interest rate, points, broker fees and certain other credit charges a borrower is required to pay. Because these costs are rolled in, the APR is usually higher than your interest rate.

Appraisal – A professional analysis used to estimate the value of the property. This includes examples of sales of similar properties. This is a necessary step in getting your financing secured as it validates the home’s worth to you and your lender.

Closing Costs – The costs to complete the real estate transaction. These costs are in addition to the price of the home and are paid at closing. They include points, taxes, title insurance, financing costs, items that must be prepaid or escrowed and other costs. Ask your lender for a complete list of closing cost items.

Credit Score – A number ranging from 300-850, that is based on an analysis of your credit history. Your credit score plays a significant role when securing a mortgage as it helps lenders determine the likelihood that you’ll repay future debts. The higher your score, the better, but many buyers believe they need at least a 780 score to qualify when, in actuality, over 55% of approved loans had a score below 750.

Discount Points – A point equals 1% of your loan (1 point on a $200,000 loan = $2,000). You can pay points to buy down your mortgage interest rate. It’s essentially an upfront interest payment to lock in a lower rate for your mortgage.

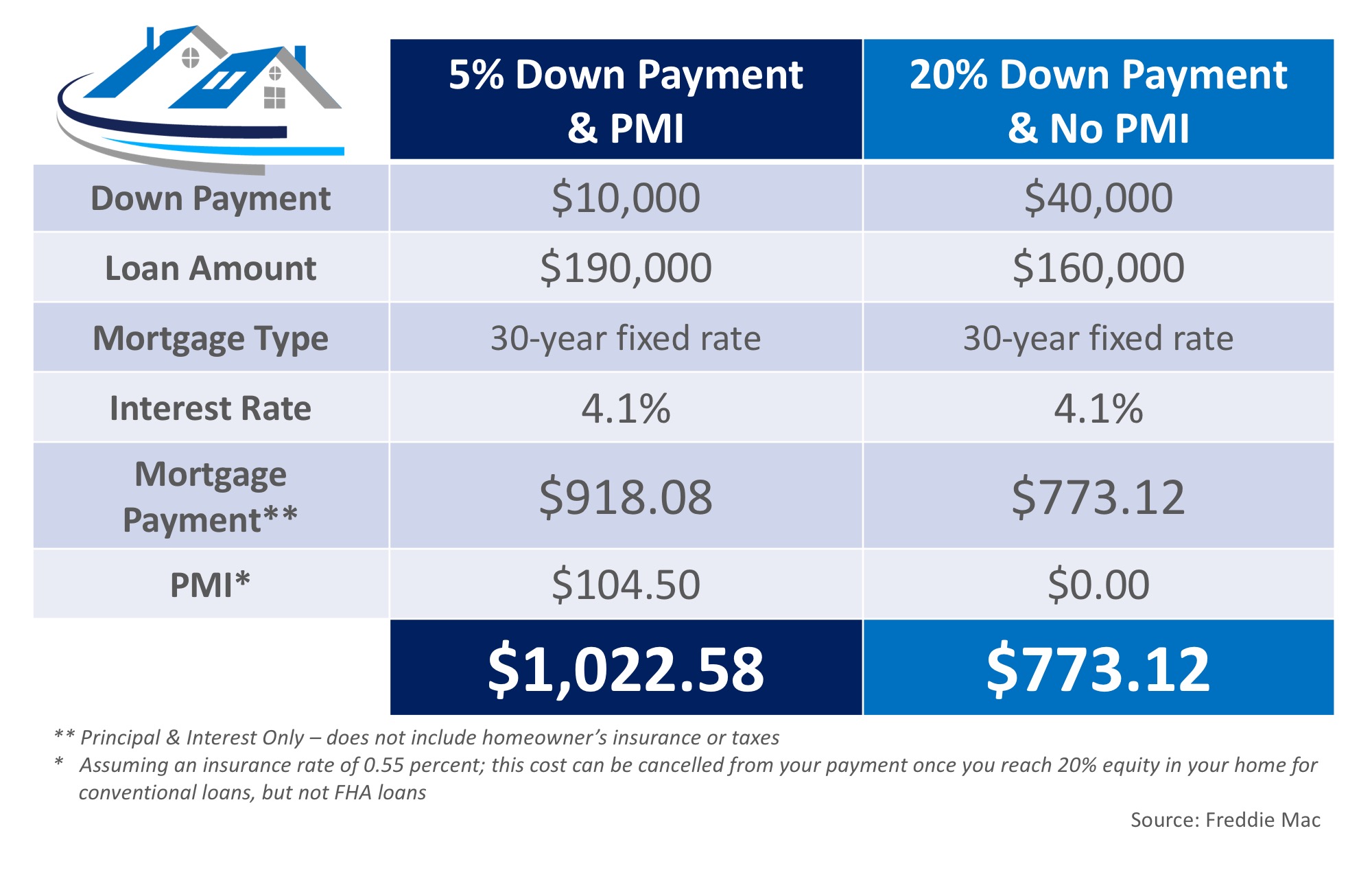

Down Payment – This is a portion of the cost of your home that you pay upfront to secure the purchase of the property. Down payments are typically 3 to 20% of the purchase price of the home. There are zero-down programs available through VA loans for Veterans, as well as USDA loans for rural areas of the country. Eighty percent of first-time buyers put less than 20% down last month.

Escrow – The holding of money or documents by a neutral third party before closing. It can also be an account held by the lender (or servicer) into which a homeowner pays money for taxes and insurance.

Fixed-Rate Mortgages – A mortgage with an interest rate that does not change for the entire term of the loan. Fixed-rate mortgages are typically 15 or 30 years.

Home Inspection – A professional inspection of a home to determine the condition of the property. The inspection should include an evaluation of the plumbing, heating and cooling systems, roof, wiring, foundation and pest infestation.

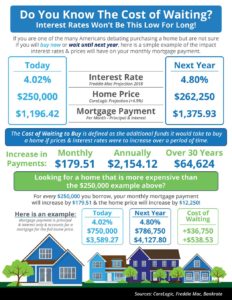

Mortgage Rate – The interest rate you pay to borrow money to buy your house. The lower the rate, the better. Interest rates for a 30-year fixed rate mortgage have hovered between 4 and 4.25% for most of 2017.

Pre-Approval Letter – A letter from a mortgage lender indicating that you qualify for a mortgage of a specific amount. It also shows a home seller that you’re a serious buyer. Having a pre-approval letter in hand while shopping for homes can help you move faster, and with greater confidence, in competitive markets.

Primary Mortgage Insurance (PMI) – If you make a down payment lower than 20% on your conventional loan, your lender will require PMI, typically at a rate of .51%. PMI serves as an added insurance policy that protects the lender if you are unable to pay your mortgage and can be cancelled from your payment once you reach 20% equity in your home. For more information on how PMI can impact your monthly housing cost, click here.

Real Estate Professional – An individual who provides services in buying and selling homes. Real estate professionals are there to help you through the confusing paperwork, to help you find your dream home, to negotiate any of the details that come up, and to help make sure that you know exactly what’s going on in the housing market. Real estate professionals can refer you to local lenders or mortgage brokers along with other specialists that you will need throughout the home-buying process.

The best way to ensure that your home-buying process is a confident one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher,’ and who puts your family’s needs first.