According to the recently released Modern Homebuyer Survey from ValueInsured, 58 percent of homeowners think there will be a “housing bubble and price correction” within the next 2 years.

After what transpired just ten years ago, we can understand the concern Americans have about the current increase in home prices. However, this market has very little in common with what happened last decade.

The two major causes of the housing crash were:

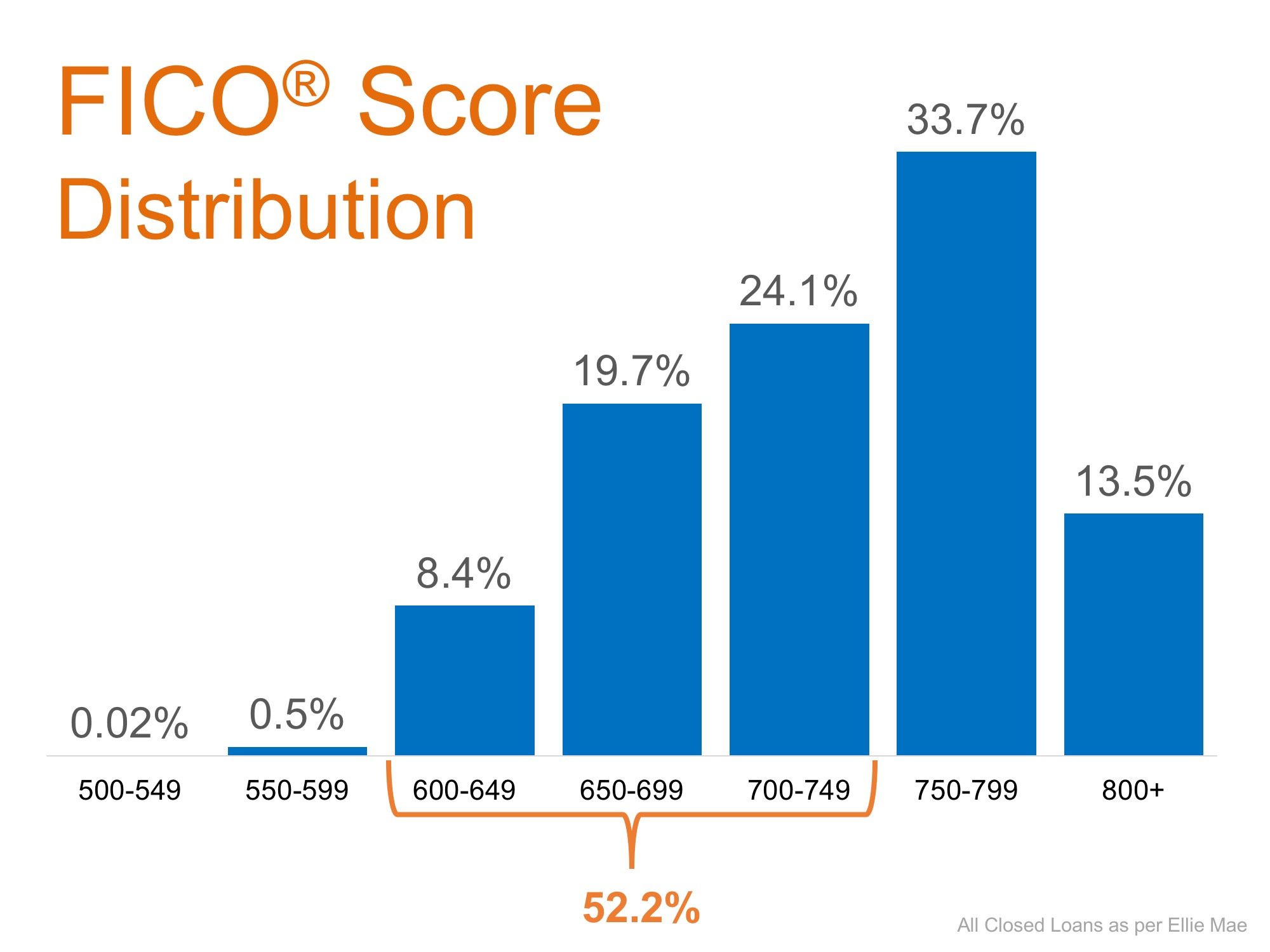

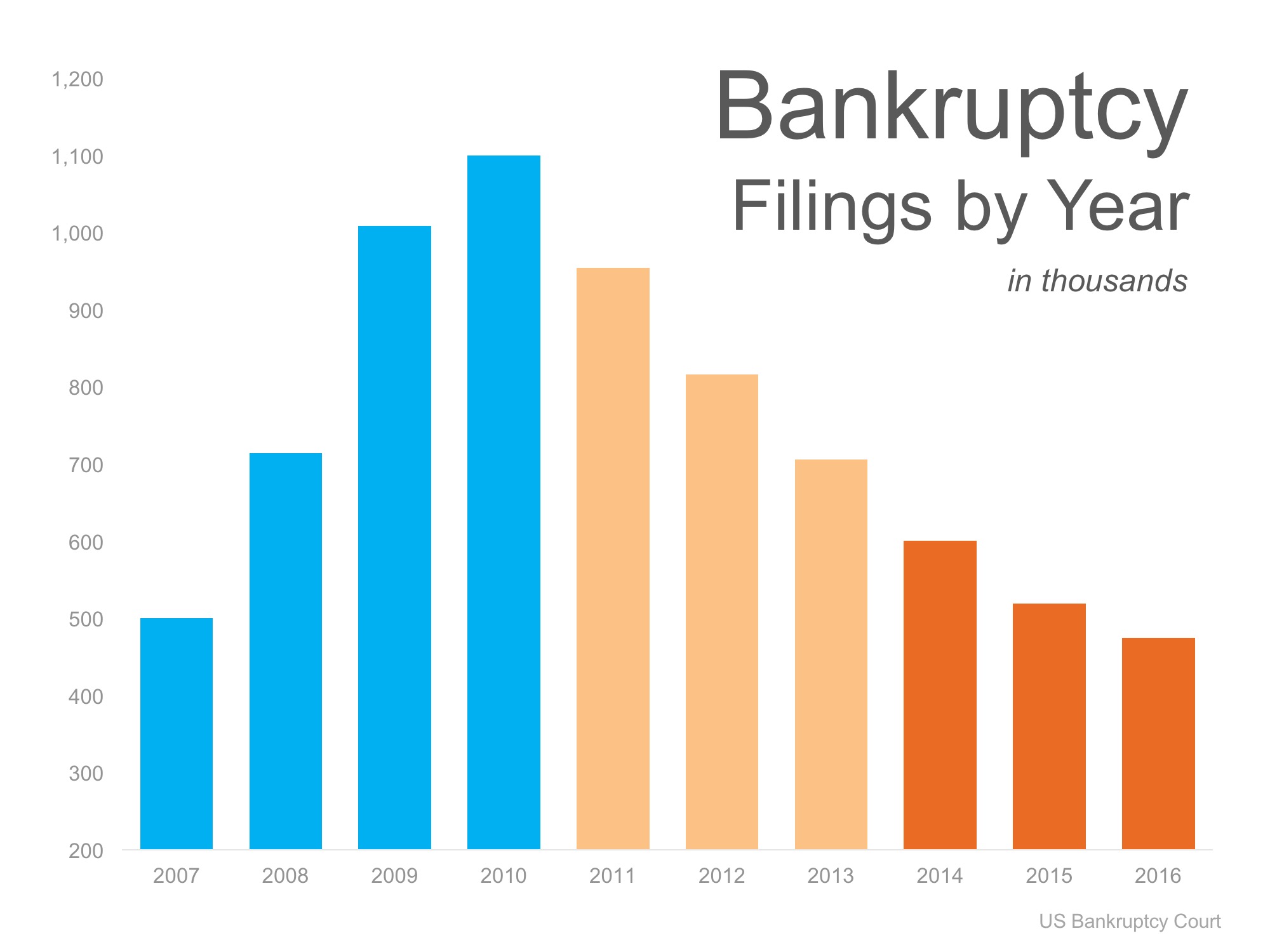

- A vast oversupply of housing inventory caused by home builders building at a pace that far exceeded historical norms.

- Lending standards that were so relaxed that unqualified buyers could easily obtain financing thus enabling them to purchase a home.

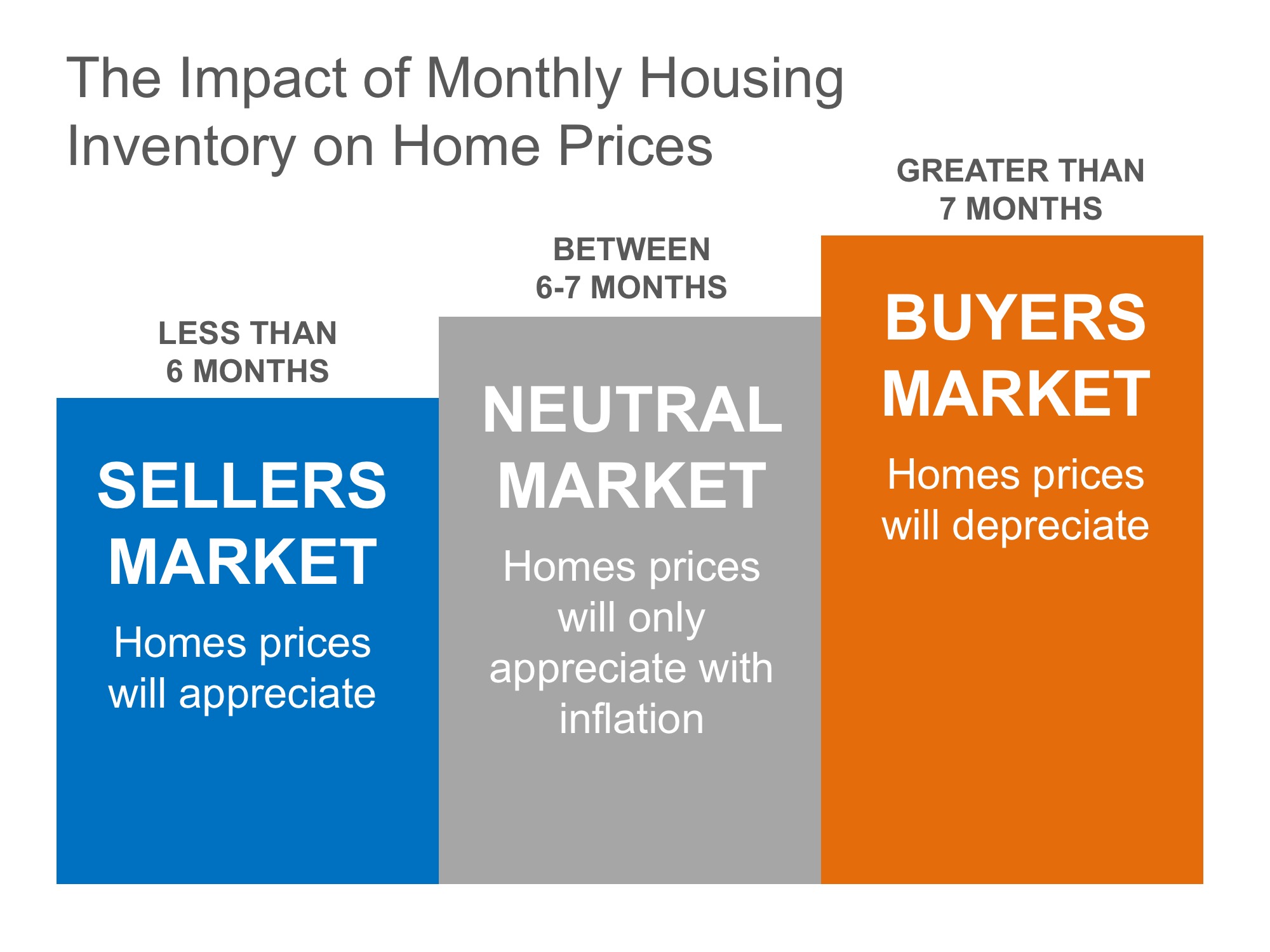

Today, housing inventory is at a 20-year low with new construction starts well below historic norms and financing a home is anything but simple in the current mortgage environment. The elements that precipitated the housing crash a decade ago do not exist in today’s real estate market.

The current increase in home prices is the result of a standard economic equation: when demand is high and supply is low, prices rise.

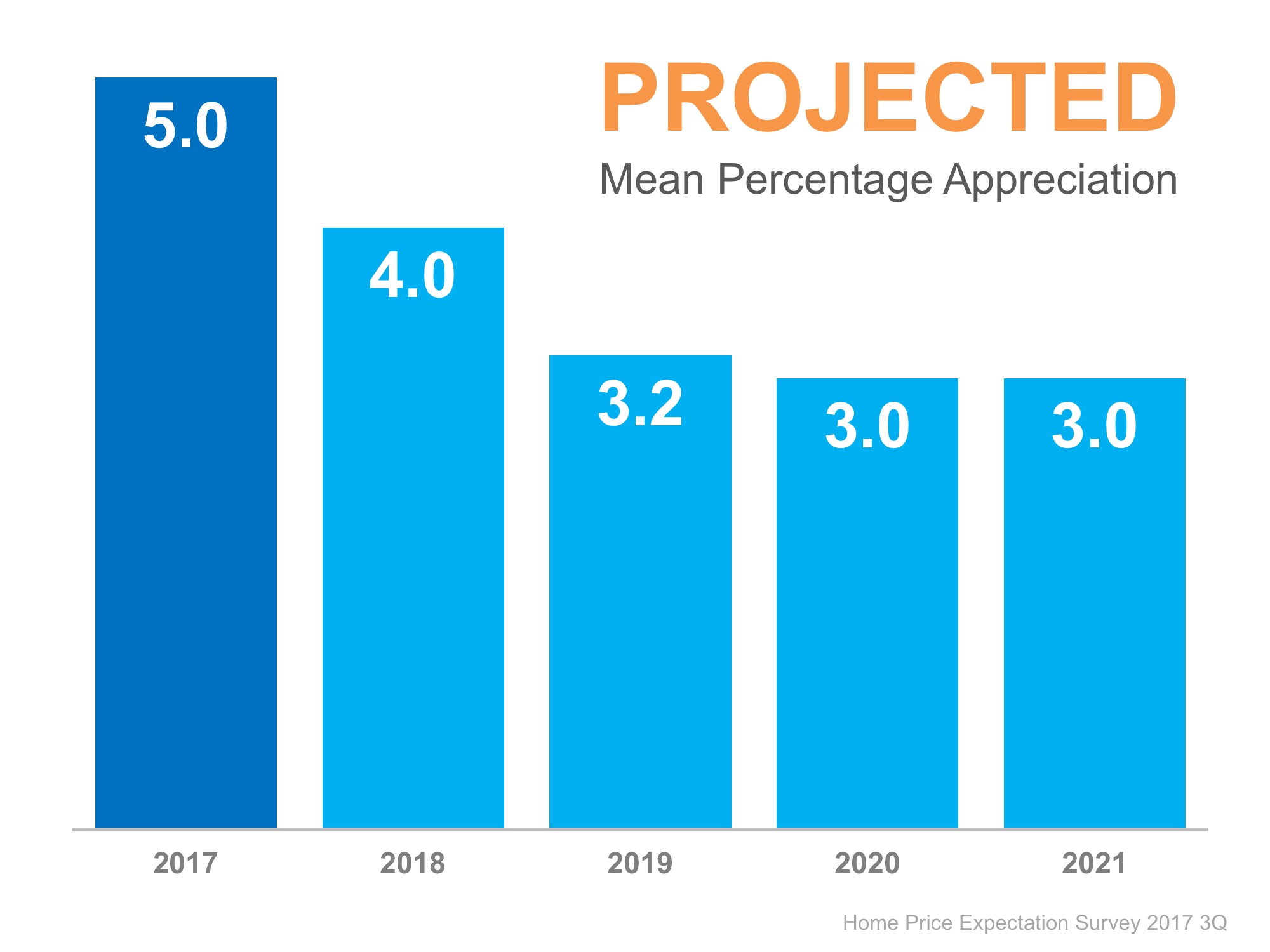

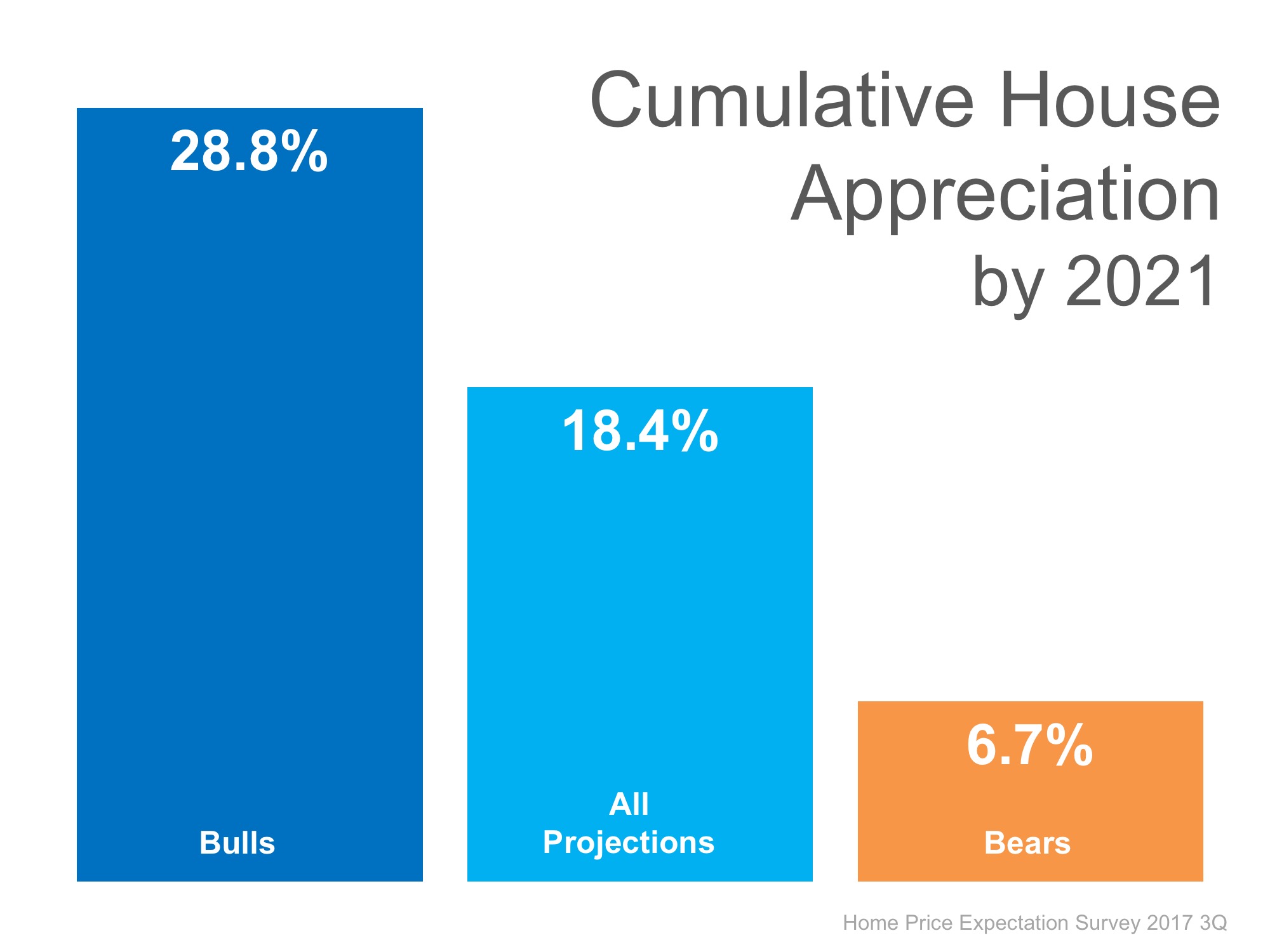

If you are one of the 58% of homeowners who are concerned about home values depreciating over the next two years and are hesitant to move up to the home of your dreams, take comfort in the latest Home Price Expectation Survey.

Once a quarter, a nationwide panel of over one hundred economists, real estate experts and investment & market strategists are surveyed and asked to project home values over the next five years. The experts predicted that houses would continue to appreciate through the balance of this year and in 2018, 2019, 2020 and 2021. They do expect lower levels of appreciation during these years than we have experienced over the last five years but do not call for a decrease in values (depreciation) in any of the years mentioned.

Bottom Line

If you currently own a home and are thinking of moving-up to the home your family dreams about, don’t let the fear of another housing bubble get in the way as this housing market in no way resembles the market of a decade ago.

![To Stage...or Not to Stage? That Is the Question! [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/08/17121633/To-Stage-STM-1046x808.jpg)