If you have already decided to buy a home, you are probably very excited, have been looking at homes online, and are geared up and raring to go tour. However, if you are getting a loan for your home, there is a very important step you should absolutely take first – getting pre-approved for your mortgage. This step is critical for a number of reasons:

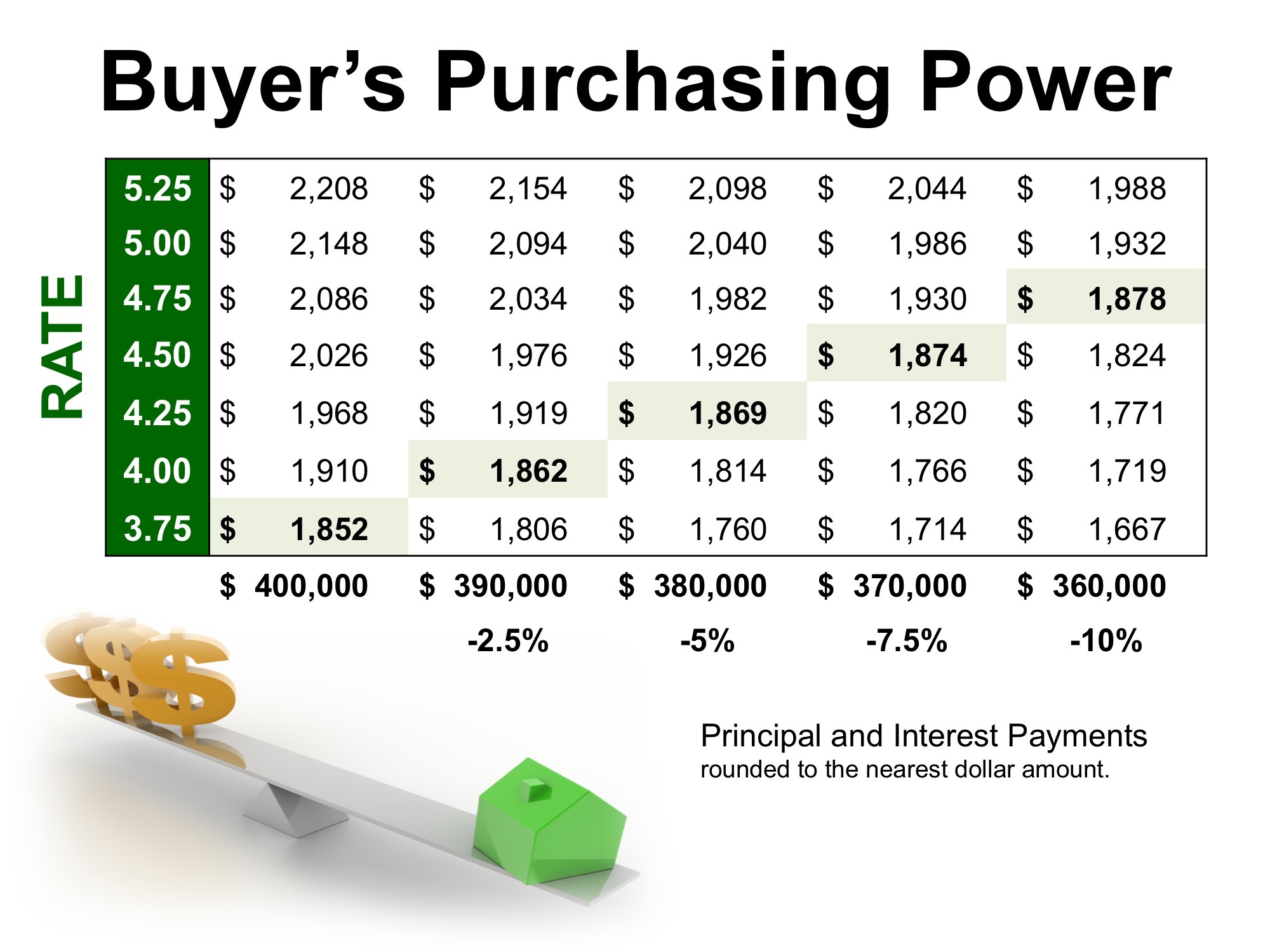

You will know your budget – There have been many situations in which the buyer was looking for homes in a much higher price range than they were ultimately approved for. You can imagine their disappointment when they realized they could only buy about half the house they were looking for. Likewise, there have been buyers who were underestimating their budget.

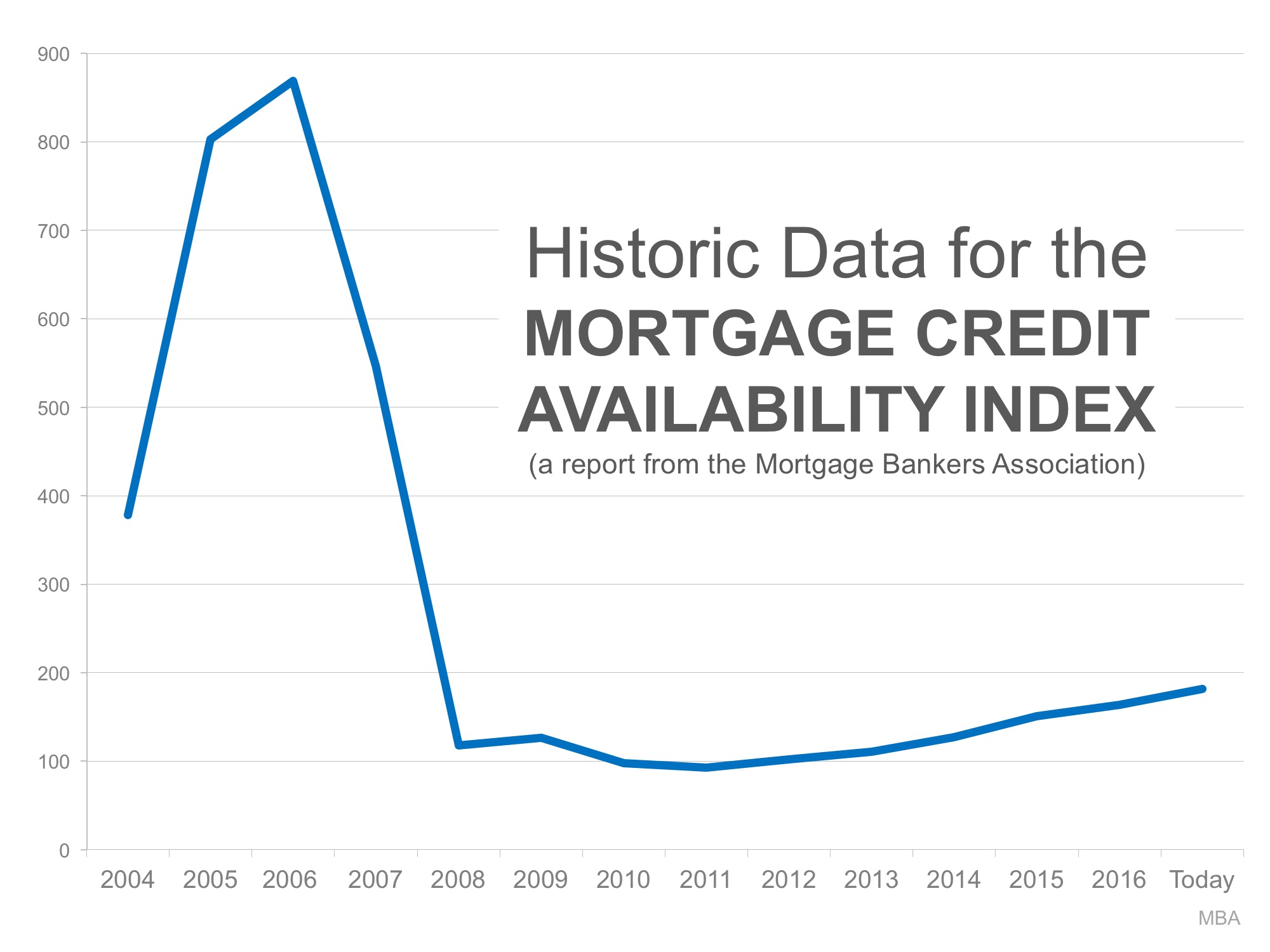

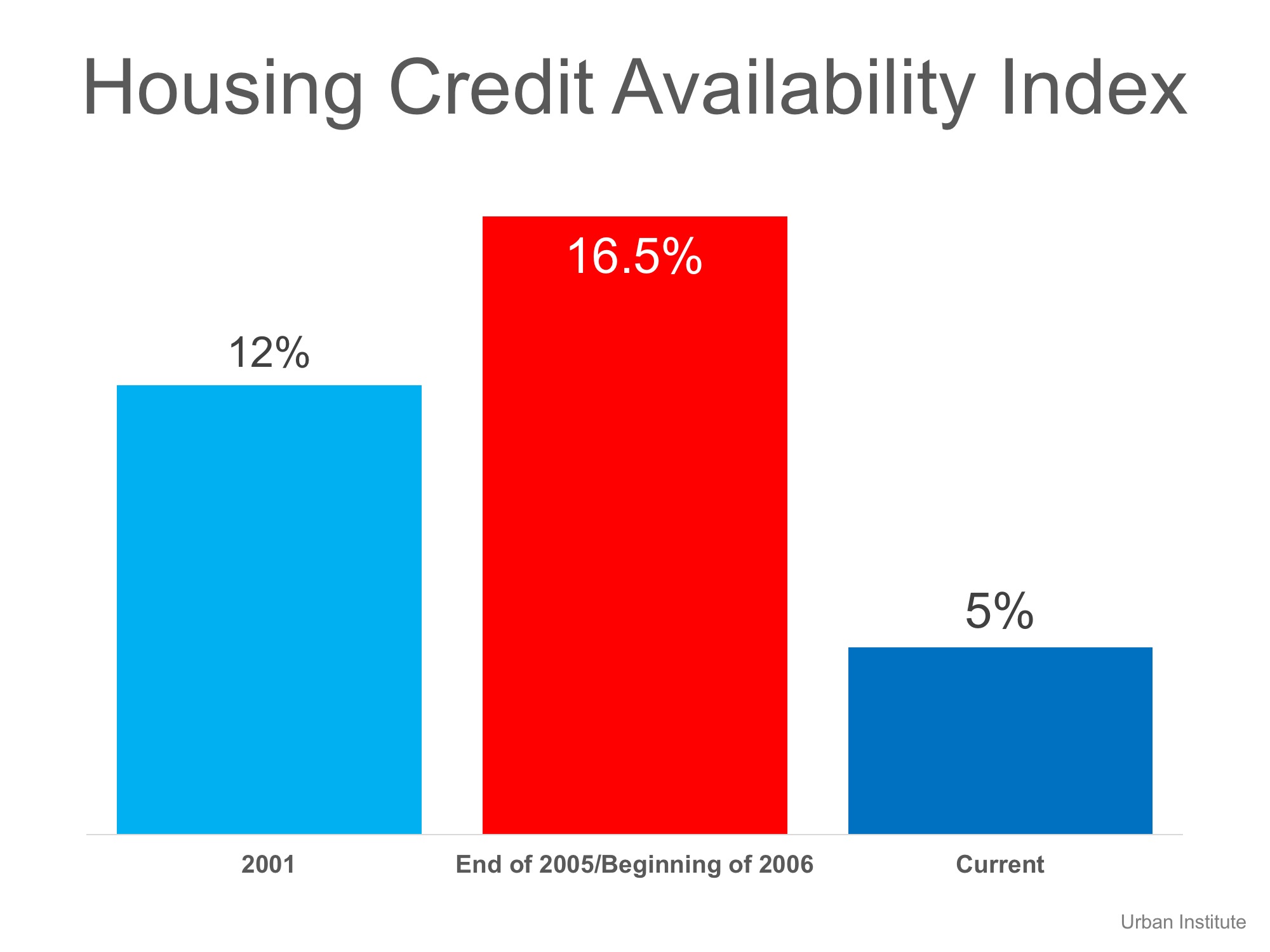

You will have already done the hard work – When you get pre-approved, the bank has already approved you as a borrower. That means that if there are any issues with credit or late payments that you might have made in the past can get cleared up before you get caught up in an offer on a house. You don’t have to worry if that mistake you made will catch up with you.

The seller will take you seriously – If you make an offer on a house before getting pre-approved and you are competing with a buyer who has already taken that step, the seller likely won’t look at your offer favorably. In fact, it is standard to include a letter of pre-approval from the bank in the offer and in some cases, the listing agent may even call the lender to learn about potential risk factors.

You don’t want to miss an opportunity to get the home of your dreams – What if you find the home that is just right, but you don’t have your financial ducks in a row? You could miss out and be disappointed. Disappointed buyers have a hard time getting over the one that got away.

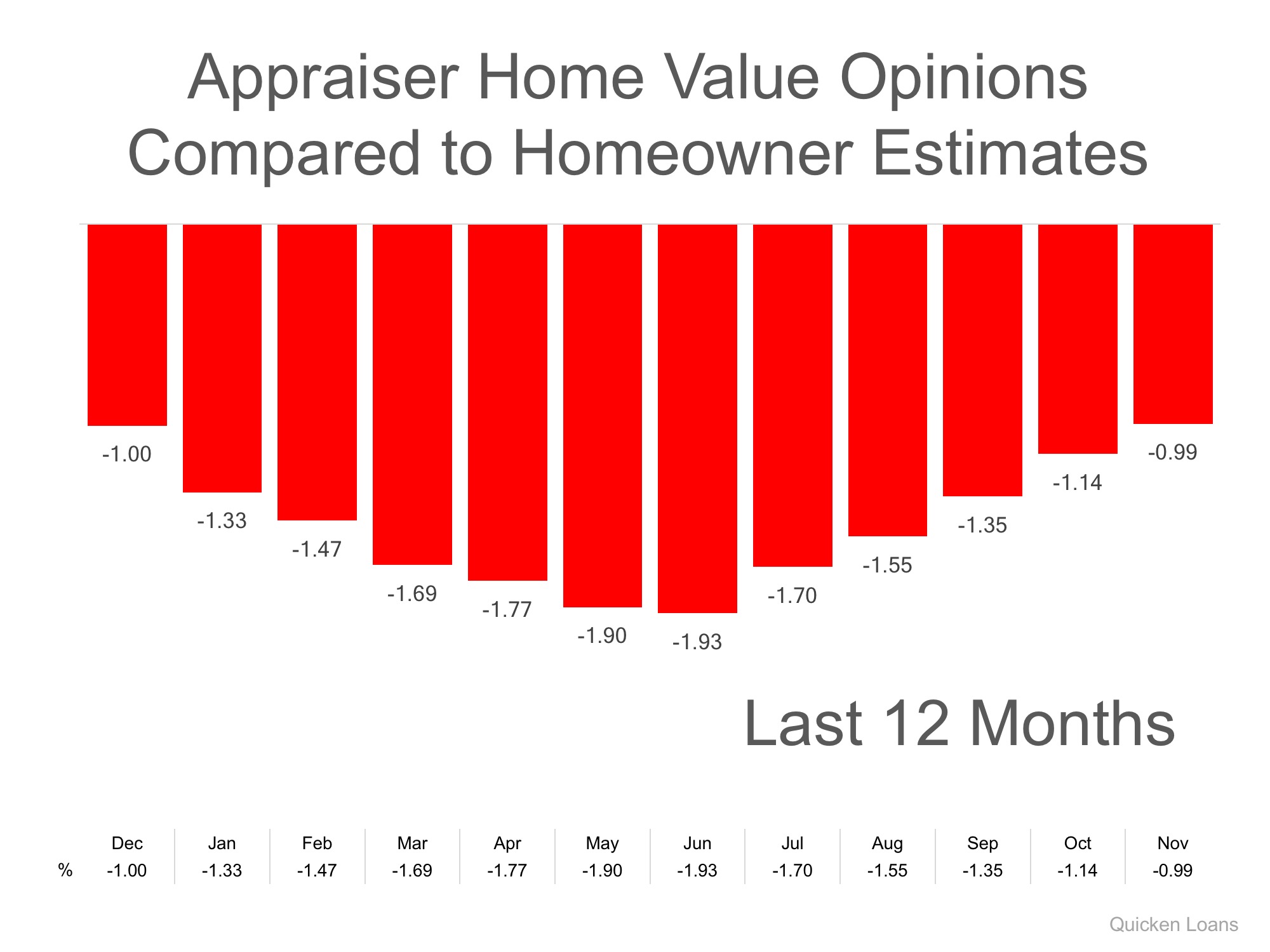

You may be able to close faster – Since with a pre-approval, you as the buyer have already been approved, it will just be a matter of making sure your chosen house is a good investment for the bank. Depending on your loan type, conventional or government-backed, there may be an inspection of the property and there will surely be an appraisal. Depending on how quickly these can happen which will depend on the lender, you may be able to close faster, which may be appealing for some sellers who need to take their next step.

Don’t underestimate the importance of getting pre-approved. The relief you will feel once a lender has indicated that you are indeed qualified to buy a home is huge. You can move forward with confidence with your pre-approval letter in hand, knowing the top end of your budget and that the seller will be ready to negotiate with you.

If you would like to learn more or be referred to lenders who would be a great match for your lending needs, please call, text, or email: (253) 222-2626 or email: john@altitude-re.com.