Each year I take time to review what has happened during the year and to look forward to predict what is in store for real estate. Below are my predictions for the 2018 real estate market, based on data that was available at the time this was written:

Interest Rates – With the Tax Reform Bill and new infrastructure, I expect interest rates to rise. A climb to 4.0%-4.5% is probable but it is possible that if the economy grows at a good clip next year, we could see rates as high as 5%. I believe the average for the year will be about 4.6%. Although this rise will cause some buyers to regroup, it will not be enough to make a strong market shift and cause buyers to leave the market in droves.

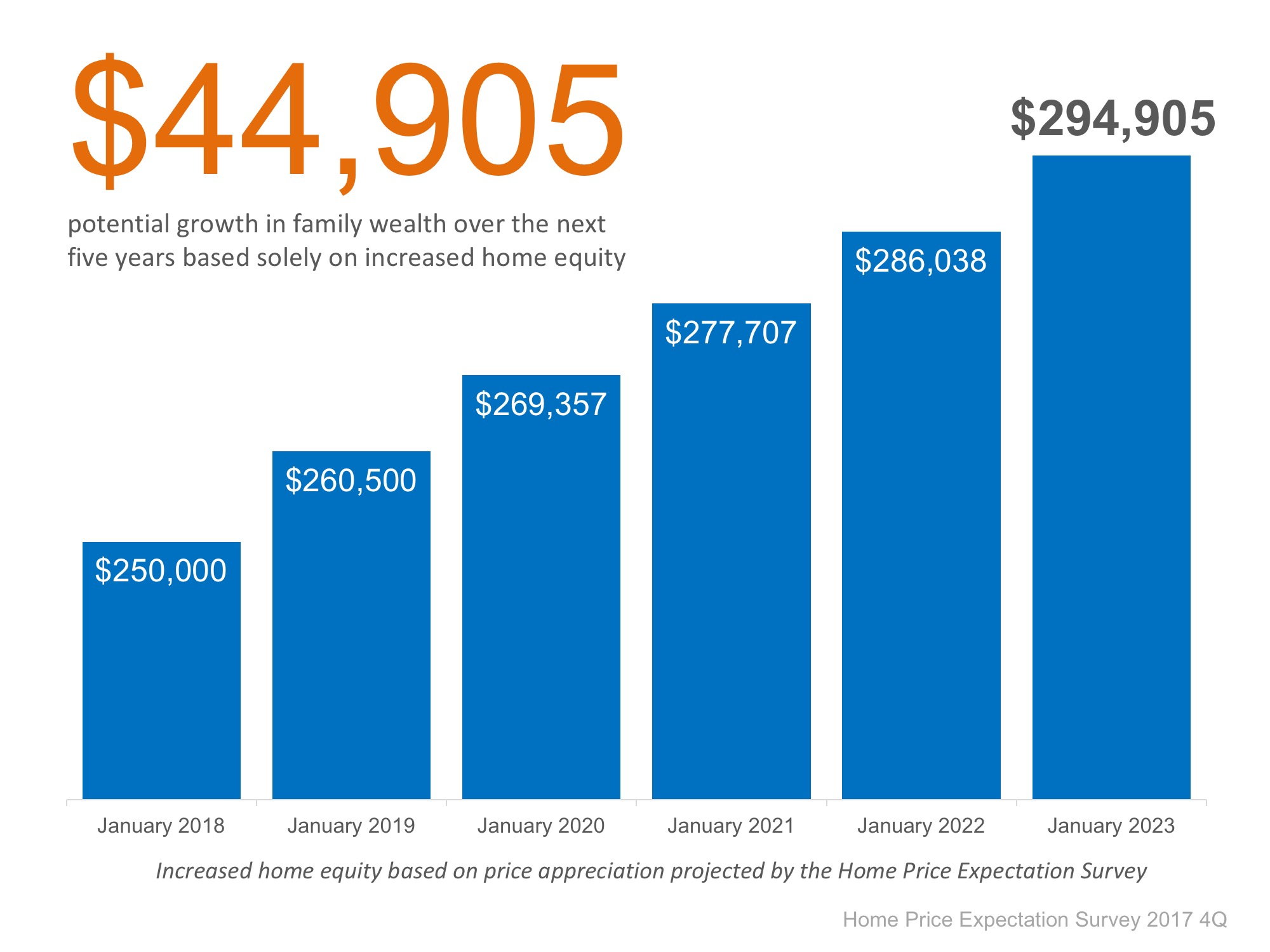

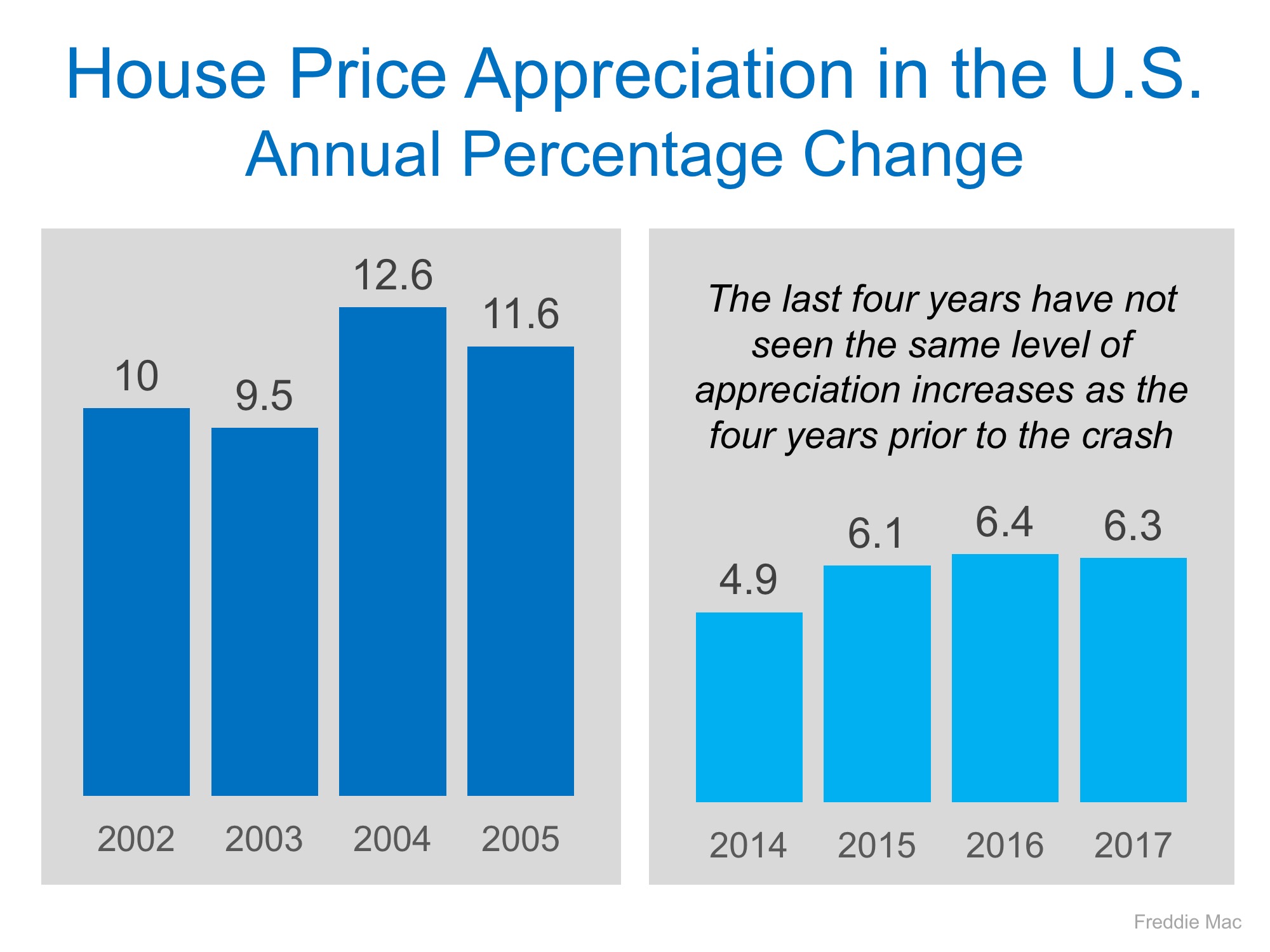

Home Price Growth – With double digit percentage price increases in many markets across the country in 2017, I believe we will move back to price inclines below 10% in those busy markets. In fact, I foresee that the average for those areas that did see such strong increases in 2017 will scale back to about 4-7% gains in 2018. Nationally, I expect prices to increase about 3.2%. Although we still have significant challenges with our inventory, incomes cannot sustain the rapid price growth we have seen regionally over the last few years, and therefore, prices will not rise as quickly.

New Construction – There is still a severe shortage of new construction. Our country needs about 1.5 million new starts per year to maintain inventory, but since 2009, we have been short a cumulative almost 6 million units. This is one of the primary causes of our inventory shortage and what is driving prices up – demand outweighs supply. Local issues in many areas such as zoning and water rights are also capping new construction opportunity. In addition, the cost of building supplies is causing problems for our builders and I expect this problem to worsen in 2018. Since the market correction, we are still not back up to the 1.5 million starts needed (2016 projection is 1,173,800 units), so our new construction inventory crisis will continue until we can replace the six million units we are short AND get back on track to 1.5 million starts per year. I don’t foresee us making gains in this category in 2018.

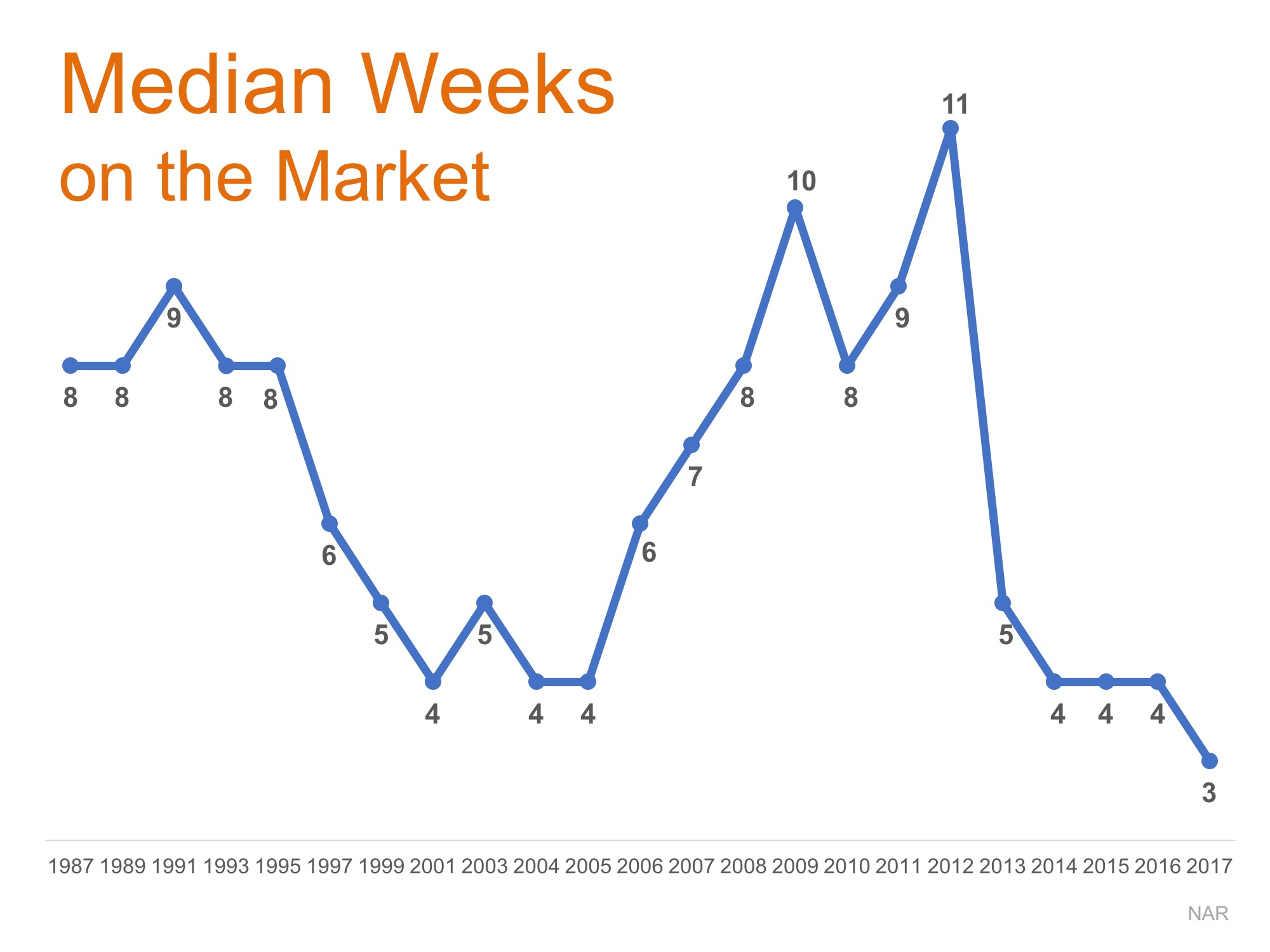

Housing Inventory – Although there are improvements in this category because we are adding some new housing units, it may take years or more for inventory levels to get back to a balanced level. Our inventory shortage was caused by a shortage of housing starts that began during the recession as outlined above. We will continue to see inventory challenges until new construction picks up even further. Additionally, I predict that more buyers will be entering the market for a home as our economy is strong with low unemployment, which I suspect will get even lower due to our economy. According to the Bureau of Labor Statistics, the national unemployment rate stands at 4.1% for November 2017, which is the lowest it has been since December of 2000. I predict unemployment to be in the high 3% range by the end of 2018. High demand and low amounts of new construction means a continued inventory crunch, although a rise in interest rates may relieve this demand a touch.

Furthermore, I am often asked when the bubble will burst or we will see another crash. I do not foresee this in the upcoming year. Although we are seeing prices rise quickly, the conditions that our national market is facing now are not the same as what we saw just a decade ago. There isn’t the easy access to credit as was before the last crash when banks were more de-regulated. There aren’t enough new or resale home to satiate current demand, unlike the building boom of the mid-2000s. Buyers are not overleveraged and, in many cases, have to put more cash down to compete in multiple-offer situations allowing buyers to start in a higher equity position. Based on our history and the facts that are in front of us, I don’t believe another crash is likely at all.

I am excited for what 2018 has in store! For additional information and predictions on our local market, please call or text: (253) 222-2626 or send an email to john@altitude-re.com.